In other words, Orthodox Elliott Wave is confusing and the alternative counts are too numerous with the subjectivity and almost always in the long run, all orthodox Elliotiticians would most likely lose, if they trade, purely on forecasting basis and without focusing the present, based on identifying the Naked Chart for the Trend until the weight of the evidence shows that trend has reversed.īut NeO Wave, the advanced fractal Elliot Wave Analysis of Glenn Neely is the most scientific with very rigid rules and objective and useful for the very long term Trends of months and years including Secular Trend of Jugular Cycles( 14 year+ or minus 5 years) in Stock Market.Home hot new top chat PLEASE READ THE WIKI/FAQ BEFORE POSTING ANY QUESTIONS THE WIKI AND THE FAQ Hall of Fame Threads (really good education within) Live Trading Chat Subreddit Rules: 1 - No off-subreddit discussion (soliciting for DMs,) or promotion of your trader group or chatroom.Ĭomments must be related to the question. More than 99 % of the Elliotticians across the world is very subjective in the sense that not only every Elliottician with the mastery of the orthodox Elliott Wave analysis would give different counts on Elliot Wave, but also the same Elliotician will interpret the Elliott Wave count differently at different times of the day, from what he thought and counted on the chart, earlier on the day!.

One must necessarily take telephone course twice a week or more over a period of two years or more in order to understand the scientific fractal based wave analysis, memorizing the enormous number of rules with rigidity of the "The advanced Elliot Wave- called NeO Wave of Glenn Neely" as opposed to the flawed subjective orthodox Elliot Wave, being practiced by most.

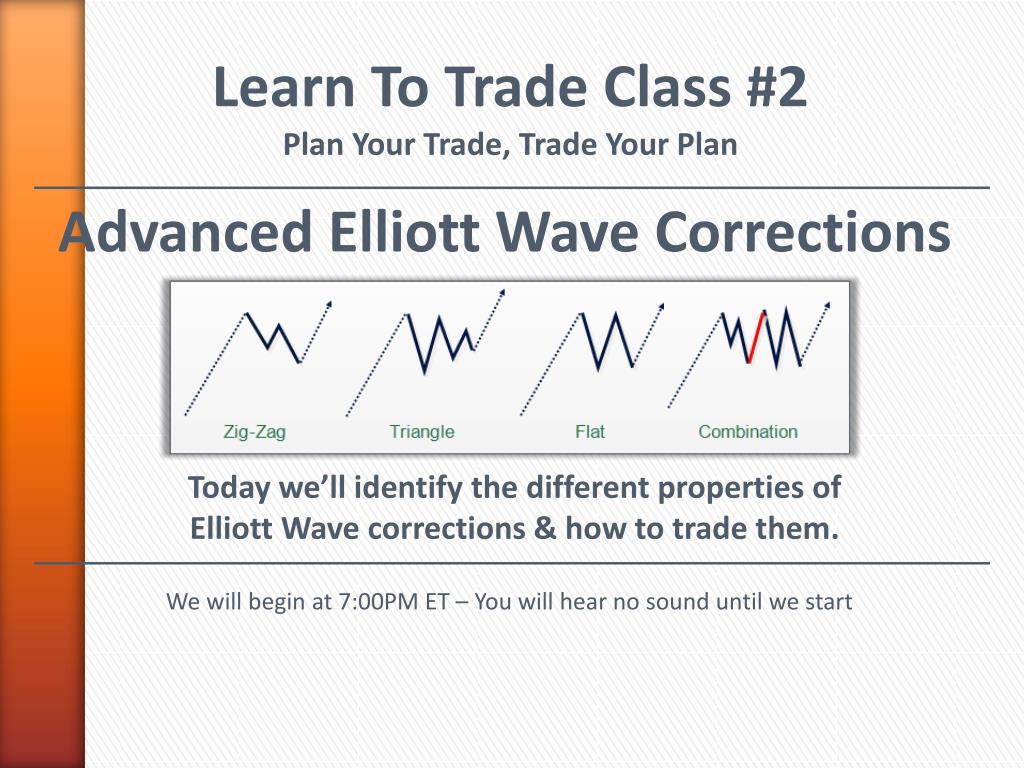

Because you will find quickly on your own, how important it is to learn from him, spending enormous amount of time and money. One can not master the Advanced Elliot Wave, by Glenn Neely, reading his book by name " Mastering Elliot Wave ", revised edition in 1990. It is also interesting to note the patterns have also changed over the years, using Advanced Elliott Wave Counts, based on the numerous rules and the different method of drawing the waves, based on which end of the each price bar came first. he himself agrees that NeO Wave itself would not help trading, because it if forecasting, however scientifc he made, far better than the Orthodox Elliot Wave. He manages a fund, traded on the basis of combined approach with River-wave theory, focused on the present without forecasting in conjunction with his very scientific Advanced Elliot Wave which has more than 35 patterns with the rigid rules. In fact he does the wave counting for only a few futures, S& P, 10 yearT Notes, Gold and Euro Future. Myself trained by Glenn Neely as the student of probably the longest duration over several years, spending enormous amount of time and money and getting certified by him, I can say that it is impossible to count the correct waves in the currency pairs in very scientific way of Glenn Neely who deserves a Noble Prize, because it requires enormous amount of time to count and draw the NeOWave-(advanced Elliott Wave). Of -course it is helpful to identify the complex corrective waves of consolidation, but not necessarily the exact type. Predicting or forecasting is a guarantee for disaster. Glenn Neely had discovered an advanced version of Elliot with the rigid rules and the evolving different patterns, as the market is changing over the years, for which he has given new names, unknown to orthodox Elliotticians. I found orthodox Elliott Wave, flawed, having many serious pitfalls.Īfter having taken Elliot Wave Analysis by Robert Prechter and his associates, in 1988, I practiced Elliot Wave in my trading with the disastrous results not only because of the forecasting nature and its too much subjectivity of the orthodox Elliott Wave of Robert Prechter. I like to state that the orthodox Elliot Wave analysis by Robert Prechter and the most scientific Advanced Elliott Wave analysis by Glenn Neely, which is called NeO Wave with the rigid enormous number of rules and the very method of looking at each bar, which end of the price bar came first in counting process, are different in each of these Elliott Waves.

0 kommentar(er)

0 kommentar(er)